Acquiring a new customer can be 5 to 25 times more expensive than retaining an existing one, which is why many businesses focus on improving customer loyalty and increasing their average customer lifetime value (CLTV).

CLTV tells you how well your business is connecting with your target customers, how much your customers like your services and products, what you are doing right, and more importantly, where you can improve. It maps the complete customer journey, calculates acquisition costs, and it tells you what keeps a customer coming back.

When your CLTV increases, you know you are making a good impression on your existing customers and you can use those same tactics to provide a better experience to your future customers as well.

In this article, we’ll discuss everything you need to know about CLTV and how to calculate it effectively.

Click here to learn about “LTV/CAC: Avoid 3 mistakes while calculating it”.

Jump ahead to:

What is CLTV?

Customer Lifetime Value (also known as CLTV, CLV, LCV, or LTV) is the projected average revenue that a single customer can generate during their entire lifetime. In other words, it is the total revenue a company can expect from a single customer’s account. Companies use the CLTV metric to identify valuable customer segments that generate the most revenue.

Moreover, the customer lifetime value or CLTV is also directly dependent on the customer’s relationship with the brand. The longer a customer continues to make purchases from a company, the higher their CLTV becomes. An ideal CLTV is higher than the customer acquisition costs and it is based on customer loyalty.

For example, if a customer continues to buy services or products from your business for over 10 years and spends approximately $10 every year, then their customer lifetime value will be $100, minus all the extra money you spent in acquiring that customer.

Let’s say that you spend about $20 in acquiring a new customer and $10 in retaining an existing customer, then your profit margin will be $70 per customer.

Why is CLTV so important?

1. CLTV tells you how much you should be spending on customer acquisition

Unless you know exactly how much money you can generate from every customer, you won’t really know how much you will need to spend in order to acquire new customers.

To make a profit, your customer acquisition costs (CAC) should be either equal or less than the average CLTV. In other words, the cost of acquiring a new customer should be lower than the revenue generated by the customer throughout their lifetime.

2. CLTV helps understand customer behavior better

With CLTV available for each customer, you can segment your customers into different categories based on their total lifetime values. You can identify customers with the highest CLTVs who raise the maximum revenue for the company and focus on retaining them. It’s also possible to acquire new customers with similar backgrounds, interests, and behaviors as your highest CLTV customers through lookalike modeling.

3. CLTV goes beyond numbers

It’s a competitive digital world today where every brand is trying to get the customer’s attention and the price is not the only factor that determines the purchasing decisions of customers. CLTV is a customer-centric metric that forms an incredibly powerful base for you to acquire new customers, retain existing valuable customers, improve customer experience, and increase revenue even from lesser valuable customers.

4. CLTV tracks the complete customer journey

Customer Lifetime Value or CLTV is more than just one single metric. It goes beyond individual customer purchases and maps the entire customer journey. It tracks when, where, how much, and how often your customers make purchases. By answering these questions, CLTV gives you access to invaluable insights which can in turn help you create more targeted and effective campaigns.

How to calculate the CLTV

There are several ways to calculate CLTV for your business. Your CLTV can either be predictive or historic–That is you can either calculate it based on what you predict your customers will spend or based on the actual purchases made in the past.

Regardless of how you calculate, your company’s CLTV can give you a clear idea about the average profit margins for purchases, the maximum amount you can spend in acquiring a new customer (customer acquisition cost or CAC), and the average period of relationship with customers.

The way you calculate the CLTV will also depend on your business model. For instance, it is relatively easier to calculate your CLTV if your company has a subscription model but it can be harder to calculate CLTV if you have an eCommerce website or multi-channel purchase points.

Here are three ways you can calculate CLTV

1. Simple CLTV equation

CLTV = 52 (A) x T

A is average customer value per week which can be calculated by multiplying average customer expenditure per visit with the number of visits per week/purchase cycle

T is Average customer lifespan which is the average number of years someone remains a customer

2. Custom CLTV

CLTV=T(52 x S x C x P)

T is the average customer lifespan

S is the average money customers spend on one visit

C is the number of times customers visit in a week

P is the average profit margin per customer

3. Traditional CLTV

CLTV = M(R/1+I-R)

M is the average gross margin for the given customer lifespan

R is the average customer retention rate

I is the rate of discount

How to boost customer lifetime value effectively

1. Funnel traffic from your social media pages

If a customer makes a purchase from you, they are likely to follow your brand on social media platforms as well. You can use this opportunity to your advantage to keep in touch with regular customers through social media. Share your regular offers, sales, and limited time flash deals so you can convince customers to make purchases with you again. Regularly interacting with your followers is also a great way to funnel traffic from social media, increase overall brand awareness, and directly improve customer lifetime value as well.

2. Retarget customers

One of the best ways to improve customer lifetime value is by retargeting and re-engaging customers who have previously interacted with your brand. You can retarget customers who have interacted with a previous ad campaign, subscribed to your newsletter, added products to their cart, and left before buying anything or those that haven’t made a purchase in a long time. Since customers already know about your brand at this point, retargeting is all about convincing them to make a purchase and increase their customer lifetime value.

3. Increase customer satisfaction

When customers are happy and satisfied with your products and services, they will always feel inclined to buy from you — It’s just as simple as that. Start by focusing on a more prompt social media presence and pre-sales assistance so that your prospective customers can get a clear idea about your products and the kind of support that you offer.

You should also provide an optimum buying experience for customers. People often fail to purchase products from a brand that doesn’t offer them a good buying experience. It’s common for customers to get irritated if they face difficulties in making a purchase or if you ask for too much information from them.

The ideal buying experience is one that allows customers to make a purchase as quickly and as easily as possible. Complicating the entire purchase process will only discourage first-time customers or cause your existing customers to completely boycott your brand.

CLTV is a crucial metric for businesses

Customer lifetime value matters way more than you think it does. It directly affects customer retention rates, customer acquisition costs, reveals the amount of customer loyalty you have and helps your business make better data-driven decisions.

Calculating CLTV manually can be a tedious process since you would be required to extract data from multiple channels, combine it together, and then apply complicated equations. Not only is it extensively time-consuming but calculating everything manually can also make it prone to errors.

Instead, you can automate the entire process with the help of a marketing tool like EasyInsights which automatically syncs and is able to fetch data from different platforms, streamline it, and provide you with the correct picture of your CLTV that helps you discover your most important customers.

How first-party data activation platforms can help you increase customer lifetime value (CLTV)?

First-party data activation platforms like EasyInsights play a crucial role in boosting customer lifetime value (CLTV) by unlocking the power of your own customer data. Here’s how EasyInsights can up your game –

1. Deeper customer understanding:

- EasyInsights aggregates and analyzes your first-party data (website behavior, purchase history, app interactions) to create a 360-degree view of each customer.

- This allows you to understand their preferences, predict future behavior, and identify high-value segments.

2. Personalized experiences:

- EasyInsights enable you to segment customers based on their unique characteristics and tailor campaigns, content, and product recommendations accordingly.

- This personalized approach fosters engagement, increases satisfaction, and encourages repeat purchases.

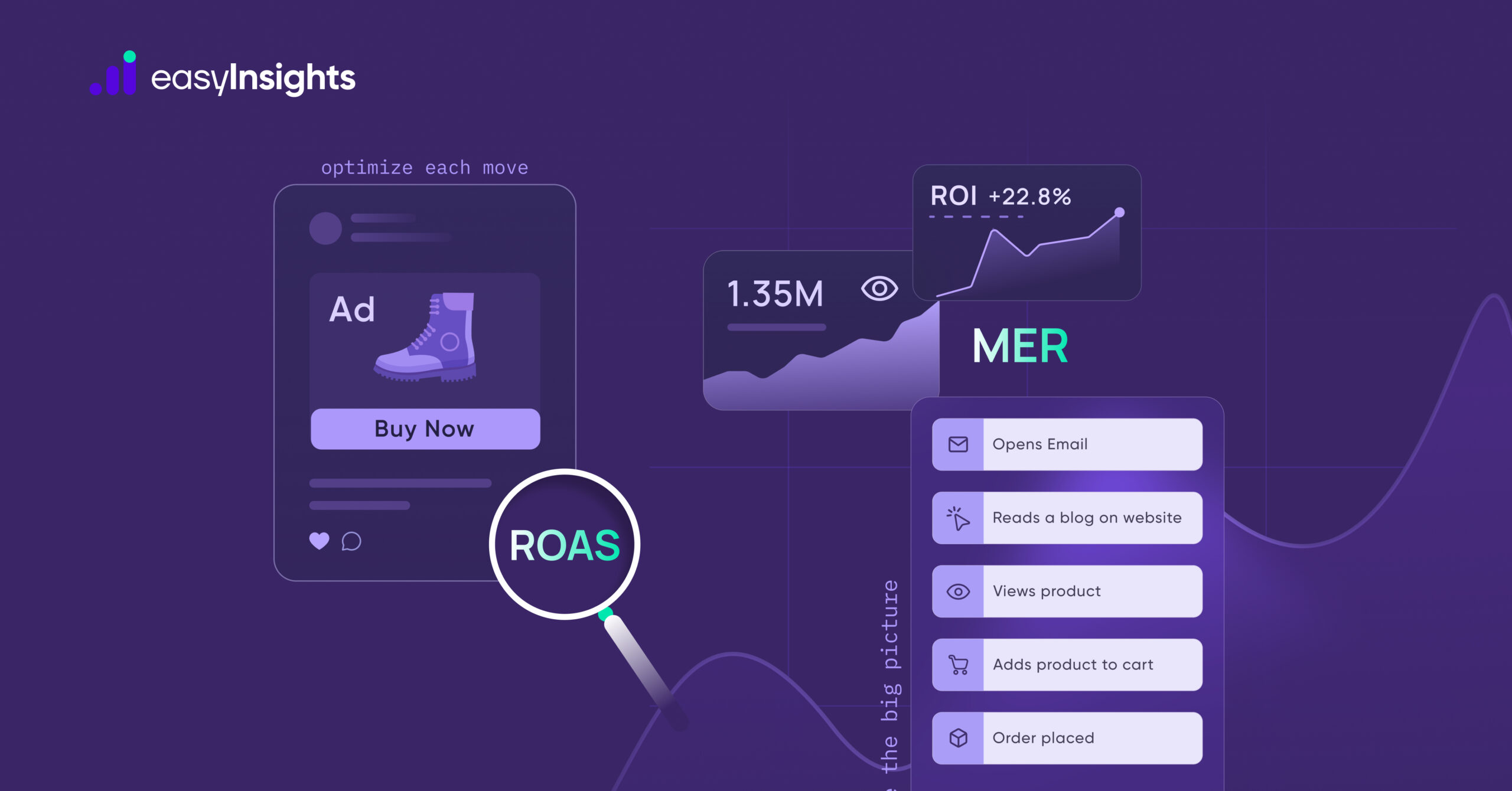

3. Improved marketing ROI:

- EasyInsights optimizes campaign targeting and messaging based on individual customer profiles, leading to higher conversion rates and reduced wasted ad spend.

- You can allocate resources effectively to channels and campaigns that resonate most with high-value customers.

4. Effective customer retention:

- EasyInsights identifies customers at risk of churn and enable you to intervene with targeted loyalty programs, personalized offers, and timely support.

- This proactive approach reduces churn and increases customer lifetime value.

5. Upselling and cross-selling opportunities:

- EasyInsights analyzes customer purchase history and preferences to recommend relevant products and services, encouraging upselling and cross-selling.

- This increases average order value and boosts overall revenue.

By utilizing first-party data activation feature of EasyInsights effectively, you can gain valuable customer insights, create personalized experiences, and optimize your marketing efforts, ultimately leading to a significant increase in customer lifetime value and overall business growth. Book a demo to know how EasyInsights can help you understand your customer behavior in a better way.