If 75% of your revenue comes from existing customers, yet your marketing budgets are overwhelmingly spent chasing new prospects. This is the reality for many brands in 2025 – Customers who bring in the richest lifetime value (LTV) are quietly slipping away, unnoticed, under‑nurtured, and ultimately under‑served.

These customers – your best, most valuable segments – aren’t just numbers on a dashboard. They are your brand advocates, repeat buyers, and the people who will spend up to 67% more than new customers when given the right experience.

Yet, without the right insights and orchestration across channels, these high‑LTV customers often fall out of sight – and out of mind.

This blog explain why they slip through the cracks and how you can reactivate them using cross‑channel insights that translate into higher retention, stronger loyalty, and maximum revenue longevity.

Jump ahead to:

What Makes High‑LTV Customers So Valuable

High‑LTV customers aren’t just big spenders, they are efficient revenue drivers:

- Existing customers spend more: Returning customers are 50% more likely to try new products and spend more than first‑time buyers.

- Retention beats acquisition: A mere 5% increase in retention can boost profits by 25–95% across businesses.

- Lower costs, higher returns: Retaining existing customers costs up to 7X less than acquiring new ones.

Despite this, many companies still prioritize acquisition over retention optimization – a strategic misalignment that costs revenue and long‑term growth.

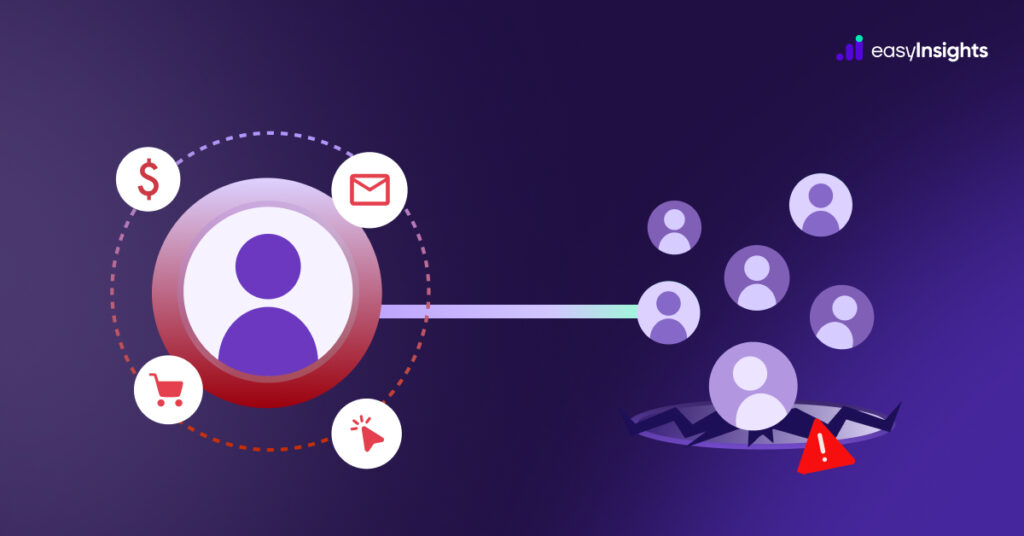

Why High‑LTV Customers Slip Through the Cracks

Let’s break down the core reasons high‑value customers are lost:

One‑Size‑Fits‑All Marketing Fails VIP Segments

Many brands treat all customers the same in campaigns and automated journeys, ignoring the different behaviors of LTV segments. This universal approach may drive activity but fails to retain and reactivate high‑LTV buyers who expect personalized experiences.

Data Silos and Channel Disconnects

High‑value customers interact everywhere – email, SMS, social, support chat, and ads – yet brands often see these interactions in isolation. Without cross‑channel attribution, brands miss the context that distinguishes a VIP customer on the verge of churn.

Lack of Real‑Time Insights

High‑LTV customers can show early churn signals – longer gaps between purchases, decreased engagement, lower open/click rates – but without real‑time monitoring and cross‑channel tracking, these signals go unnoticed.

Neglecting Post‑Purchase Engagement

After a big purchase, brands often dial back communication. This “quiet period” removes brand visibility right when a high‑value customer might be most primed for repeat purchase – a critical oversight.

Also Read: Customer Retention: Strategies and its Benefits 2025

Hard Numbers: The Cost of Neglect and the Value of Retention

Here’s why retention – especially of high-LTV customers – should be a strategic priority:

- Existing customers spend 67% more than new ones.

- Brands that follow up within 5 minutes of inquiry see a 35% higher retention.

- Personalized messages after first purchase increase 12-month retention by 26%.

- Sending reactivation messages reduces churn by 8–14%.

- Customers with 3+ purchases are 3X more likely to become long-term loyal buyers.

Impact of Ignoring High‑LTV Segments

When high‑LTV customers slip away:

- Revenue concentration collapses: Losing top spenders dramatically cuts predictable revenue.

- Referral power weakens: Loyal customers often recommend and advocate – but lost customers take potential new business with them.

- Churn masks growth: High churn doesn’t just affect numbers; it stunts company scaling and investor confidence.

Brands that fail to address churn often see existing customer revenue decline, even when acquisition metrics look healthy.

Cross‑Channel Insights: The Solution to Reactivation

So how do you pull high‑LTV customers back into the fold? The secret lies in cross‑channel insights that unify data and shape relevant experiences.

Complete Customer Profiles

A complete customer view – combining email, SMS, paid ads, onsite behavior, and support data – helps you spot early disengagement patterns that single‑touchpoint analytics miss.

Example: A formerly active buyer stops opening emails and hasn’t clicked on a retargeting ad in 30 days – a strong indicator of churn risk.

Tailored Reactivation Campaigns

Don’t send generic messages. Personalized reactivation should be based on:

- Last engagement channel

- Purchase history

- Product affinities

- Signal of dissatisfaction or silence

Using cross‑channel insights, you can design campaigns that feel relevant rather than intrusive – the difference between reactivation and annoyance.

Channel‑Optimized Sequencing

Match the message to the channel that resonates best with the customer.

- SMS for urgent offers

- Email for curated recommendations

- Retargeted ads for visual touchpoints

- Loyalty perks via push notifications

Cross‑channel orchestration increases the odds of reactivation because you’re meeting customers where they engage most.

Actionable Steps to Start Winning Back High‑LTV Customers

Here’s a practical reactivation playbook you can implement:

1. Build Comprehensive Customer Profiles Integrate CRM, web analytics, ads, email, and support data.

2. Segment by Behavior, Not Just Spend Identify those whose recency, frequency, and monetary value are declining.

3. Score Engagement Signals Across Channels Prioritize customers with high recent engagement drop-offs.

4. Trigger Cross‑Channel Workflows Automate reconnection journeys based on key signals.

5. Test & Optimize Continuously Monitor which channels and messages actually reactivate – and double down.

Where Most Reactivation Strategies Break: Measurement & Attribution Gaps

Even brands that run reactivation campaigns often struggle to prove what’s actually working.

Here’s why high-LTV reactivation fails at the measurement layer:

Fragmented Attribution Masks True Impact

High-LTV customers don’t convert in one click. They may:

- Open an email

- Ignore a retargeting ad

- Click an SMS two days later

- Finally convert via direct or organic

Traditional analytics tools credit only the last visible touchpoint, undervaluing earlier re-engagement efforts. As a result, brands often pause or underfund the very channels that are quietly driving retention.

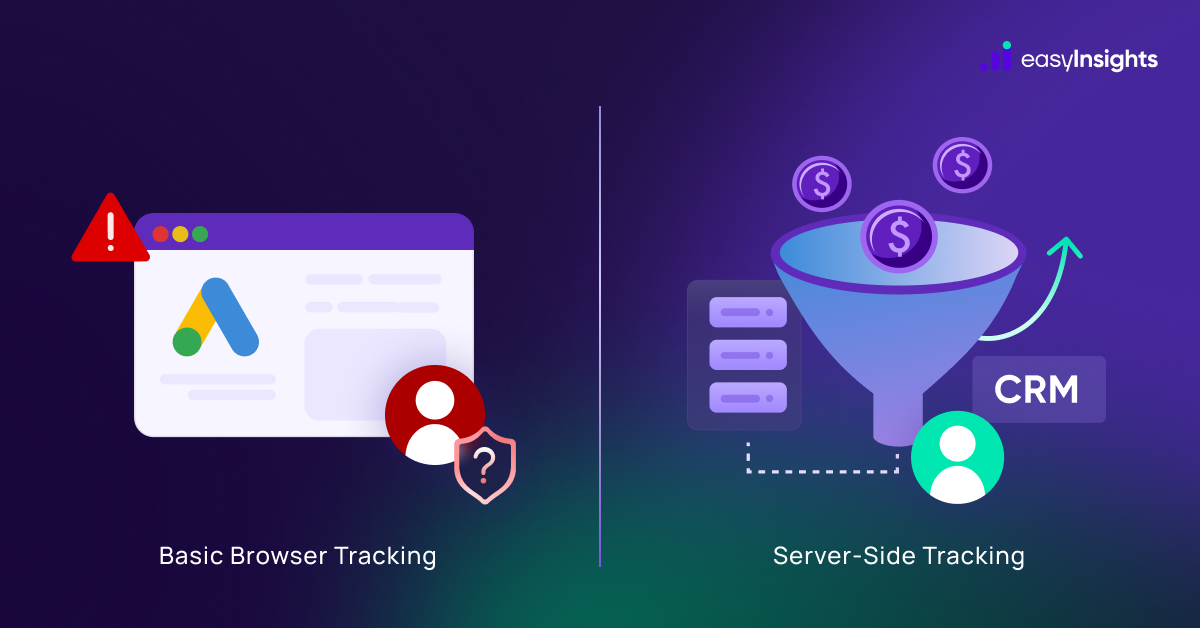

Browser Tracking & Privacy Gaps Hide Returning Customers

With cookies blocked, iOS restrictions, and browser limitations, many returning high-value users are:

- Counted as “new”

- Lost between sessions

- Invisible across devices and channels

This leads to flawed decisions – especially when reactivation campaigns appear to underperform simply because conversions aren’t being attributed correctly.

No Feedback Loop Between Retention & Paid Media

Without connecting CRM, paid platforms, and onsite behavior:

- Paid ads continue targeting already-active VIPs unnecessarily

- Lapsed high-LTV users aren’t prioritized in re-engagement

- Media spend is wasted on acquisition instead of retention lift

True reactivation requires closed-loop measurement, not just messaging.

Role of EasyInsights in High-LTV Reactivation

EasyInsights helps brands stop losing their most valuable customers by turning fragmented data into clear, actionable reactivation signals.

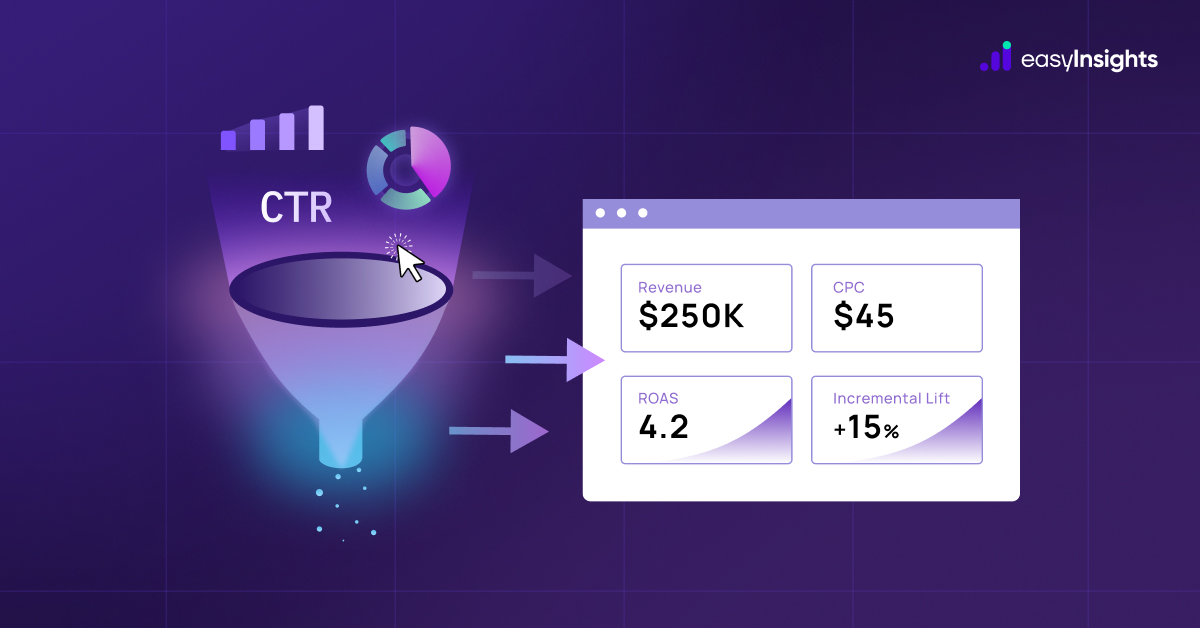

- LTV-driven event signals

Sends enriched events like Leads, MQL, SQL, back to ad platforms, training AI on real retention outcomes-not vanity conversions. - True cross-channel attribution

Measures how email, ads, SMS, and organic touchpoints work together to reactivate high-value customers-no more last-click blind spots. - Closed-loop paid media optimization

Prioritizes lapsed high-LTV users, excludes already-active VIPs, and shifts spend from acquisition to measurable retention lift.

Conclusion

High-LTV customers aren’t just rows in a dashboard or segments in a CRM – they are the foundation of sustainable growth. These are the customers who buy repeatedly, trust your brand, forgive occasional friction, and contribute disproportionately to revenue and profitability. When they disengage, the impact isn’t limited to lost sales – it shows up as unpredictable revenue, rising acquisition costs, and weakened brand equity.

The reality is that high-value customers rarely disappear overnight. They fade gradually across channels – opening fewer emails, clicking fewer ads, visiting less frequently, and delaying purchases. Without cross-channel visibility, these signals remain fragmented and invisible, leaving brands reactive instead of proactive.

Book a demo with EasyInsights to know the cross channel insights.