Jump ahead to:

Introduction

Even since the rise of the tech industry and e-commerce in the late 1990’s business is no longer about just winning more customers. Today, the profitability of modern Internet businesses depends on how efficiently they acquire those new customers.

Multiple studies indicate that the expense associated with acquiring a fresh customer is approximately 5-25 times greater than retaining an existing one. Consequently, even a slight rise in Customer Acquisition Cost (CAC) can determine whether a business thrives profitably or succumbs to overwhelming losses.

A recent survey suggests that more than half of the retailers consider the rising cost of acquiring new customers as the single biggest threat to the profitability of their operations. That makes CAC an essential metric for businesses to track to assess the effectiveness of their marketing efforts accurately.

So, let us understand what CAC is and how to calculate it. We will also look at other related metrics like Customer Lifetime Value (LTV) and LTV:CAC ratio.

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) is the amount of money a business spends to acquire a new customer. It is an important performance metric that helps businesses assess their profitability.

CAC includes all your marketing and sales expenses associated with converting a prospect into paying customer, such as sales team salaries, commissions, etc.

A high CAC is unfavorable for a company as it shows they spend more money to acquire new customers, which reduces their profitability with every new customer they gain. On the other hand, a low CAC shows that a business is efficiently bringing in new customers, keeping marketing and sales-related expenses down, which, as a result, boosts its profitability.

Besides, tracking CAC helps you identify which marketing and advertising channels are most effective in acquiring new customers, allowing you to optimize your marketing spends and improve your customer acquisition strategy. This will help increase your profitability, and grow your customer base more efficiently.

Calculating CAC

To calculate CAC for your business, divide the total amount of money spent on acquiring new customers (the sum of all your sales and marketing expenses) by the number of new customers acquired during a specific period.

Formula:

CAC = (Marketing Costs + Sales Cost) / Number of Customers Acquired

So, if you spent $100,000 on sales and $150,000 on marketing in a year, and with that total expense of $250,000, assume you won 1000 customers in the same period, your CAC would be $250 (250,000/1000). Meaning, you spent $250 to acquire one customer.

Ideally, you should measure your CAC quarterly or annually. Ensure the following expenses are included when you are calculating the CAC for your business:

- Advertising expenses like online ads, print and tv commercials, billboards, etc.

- Salaries and commissions paid to salespeople, managers, and account executives.

- Salaries and bonuses paid to content creators, social media managers, and marketing managers.

- Lead generation expenses like pay-per-click advertising, search engine optimization, etc.

- Technology-related expenses like expenses on CRM software, marketing automation, data analytics, etc.

What is the Ideal Cost of Acquiring a Customer?

The ideal Customer Acquisition Cost for a business depends on many factors, including the industry type, business model, and goals and objectives of that business. To see if your CAC is ideal, you should compare it with industry standards.

If you are an early-stage business or a startup setting up its operations, you will initially have a high acquisition cost. However, CAC will start lowering as you scale and optimize your operations.

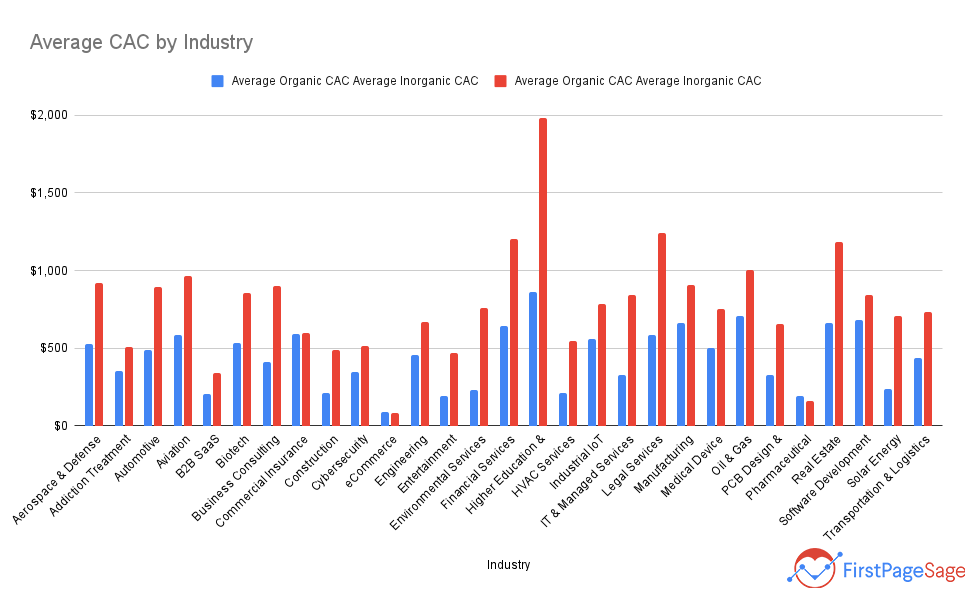

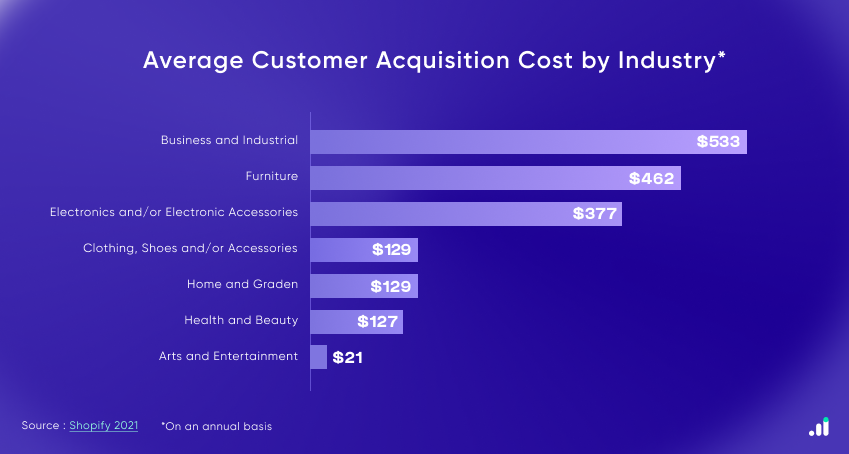

For context, here is the breakdown of average CAC for different industries:

It is important to note that a lower CAC is not always a good sign. For instance, if you have a higher customer churn rate, even a lower CAC is not a sign of profitability since your current marketing strategies are currently leading to customers that are irrelevant in the long run. Similarly, a slightly higher CAC is not a negative signal if you enjoy recurring purchases.

So, to tackle this limitation of Customer Acquisition Cost as a performance metric, businesses consider Customer Lifetime Value (LTV) and calculate LTV:CAC ratio to better understand the cost of their growth.

While low CAC may seem appealing in the short term, it is crucial to prioritize customer quality for sustainable business growth. By focusing on acquiring customers who exhibit high engagement, retention, and lifetime value, you can create a loyal customer base that fuels your business’s long-term success.

Instead of focusing solely on low CAC, consider these metrics to evaluate customer quality:

- Customer Lifetime Value (CLTV): Predicts the potential revenue a customer can generate over their lifetime.

- Engagement and retention rates: Measure the level of customer involvement and loyalty.

- Customer satisfaction: Reflects the overall happiness and likelihood of repeat purchases.

Remember: Quality customers today lead to a thriving business tomorrow.

What is Customer Lifetime Value?

Before we understand the LTV:CAC ratio, let us first go over what Lifetime Value is.

Customer Lifetime Value (LTV), also called CLV, is the overall monetary value a customer generates for a company throughout their relationship. It is an important KPI for businesses to measure since it allows you to calculate the profitability of gaining and maintaining consumers.

A highly simplified formula for LTV can be:

LTV = Average Order Value x Number of Repeat Transactions x Average Retention Time

Wherein,

- Average Order Value is the amount of money a client spends on each transaction. When calculating Average Order Value, also consider factors like changes in pricing, changes in features, upgrades/downgrades in subscription plans, etc.

- Number of Repeat Transactions is the average number of times a consumer buys from the company in a specific time period (quarterly/annually).

- Average Retention Time is the average duration a customer stays with the company.

LTV helps businesses make informed decisions about how much to invest in customer acquisition and retention. It can help you identify your most valuable customers and focus your marketing and sales efforts on upselling and retaining them.

What is LTV:CAC Ratio?

CAC:LTV ratio is a performance metric that compares the amount you spend to acquire a customer (CAC) and the amount that customer is expected to spend on your business in their lifetime (LTV).

LTV:CAC is a measure of your sales and marketing efforts’ return on investment. Comparing Customer Acquisition Cost to Customer Lifetime Value helps businesses understand the efficiency and profitability of their customer acquisition and retention strategies.

Formula:

LTV:CAC Ratio = Customer Lifetime Value / Customer Acquisition Cost

So, if you acquire a customer for $250 and the customer spends $75 every quarter for two years. Then your LTV will be $600 ($75 x 4 x 2),

and LTV:CAC ratio will be: 600 / 250 = 2.4:1

Meaning, for every dollar you spend on acquiring a customer, the customer spends $2.4 on your business.

What is the Ideal LTV:CAC Ratio?

LTV:CAC ratio of 1:1 means a business loses money with every sale.

A 1:1 LTV:CAC ratio suggests that the revenue generated from customers barely covers the cost of acquiring them. This scenario poses several challenges and risks for a business.

However, the ideal ratio varies depending on the business. For instance, if you are a SaaS company, the LTV:CAC ratio of 3:1 is generally considered profitable, i.e., you should earn at least three times what you spend on customer acquisition. Similarly, for the subscription-based business ideal ratio is around 6:1.

So, what causes a low LTV:CAC ratio? Here are some issues that lead to low LTV:CAC ratio:

- Inability to identify high-value prospects and converting them to customers

- Failure to retain customers for long term

- Poor marketing message

- Non-competitive product pricing

- Overutilization of expensive customer acquisition channels

- Excess overhead costs

Can LTV:CAC ratio be too high for a business? If your LTV:CAC ratio is way too high (generally 5:1), it indicates that you are spending less on sales and marketing than required, leaving the opportunity to win a bigger market share.

Improving Your LTV:CAC Ratio

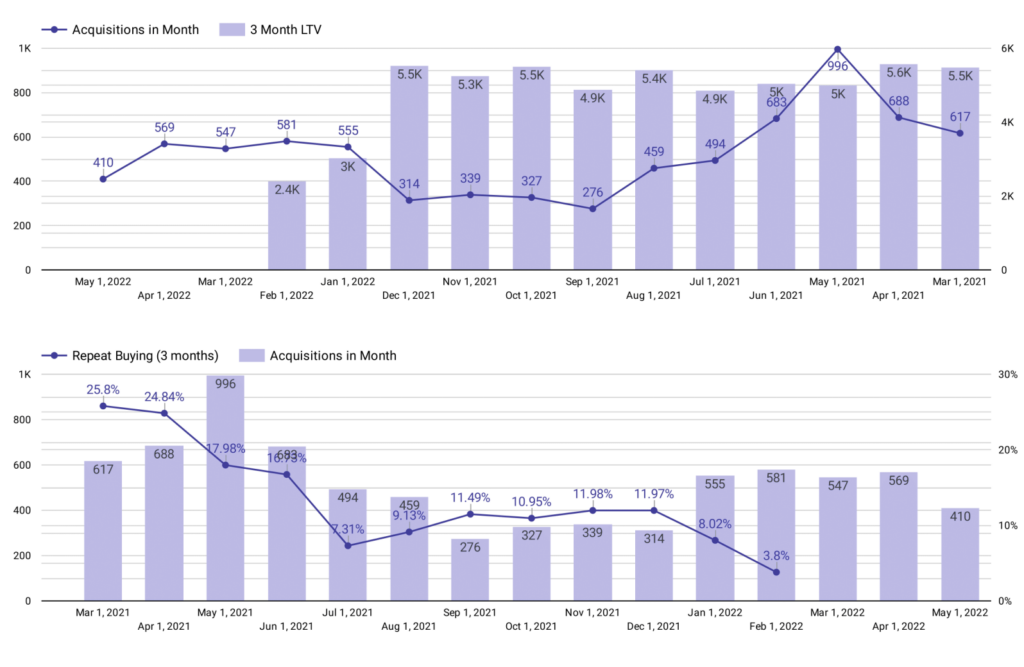

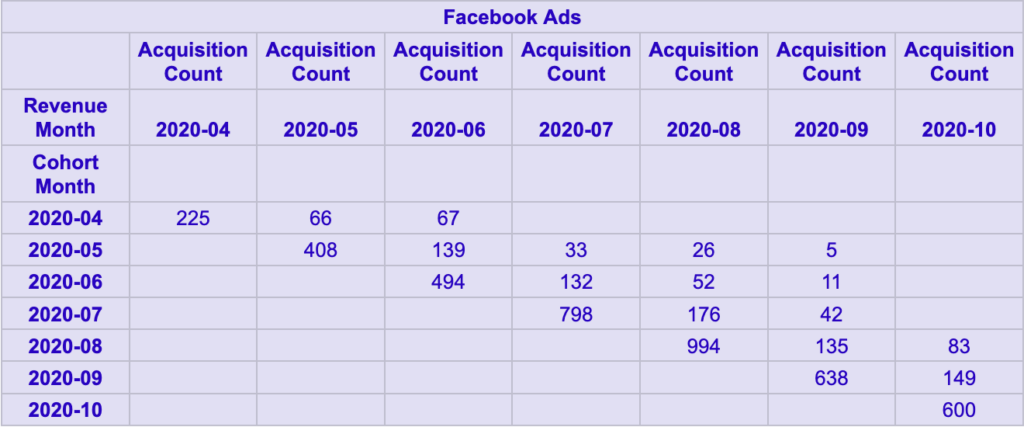

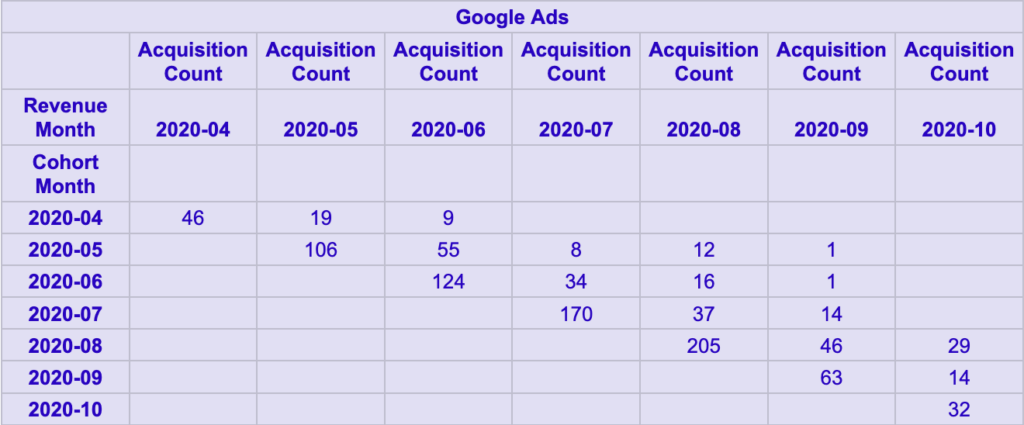

The rising cost of acquiring a new customer is the biggest factor adversely affecting the LTV:CAC ratio for most businesses. According to research, e-commerce brands today lose around $30 for every customer they acquire, compared to $9 in 2013. So, if you have to improve your business’s LTV: CAC ratio, you must try and reduce your Customer Acquisition Cost. A few sample dashboards to monitor it.

Let us look at some ways to reduce CAC to improve LTV to CAC ratio:

Use Right Acquisition Channels

The first step to optimizing your LTV:CAC ratio is to use the proper acquisition channels. As mentioned earlier, even if your acquisition cost is low, but higher churn rate lowers your ROI on sales and marketing. So, you should focus on cost-effective channels that earn you at least 3 times more money than you spend.

The right channel depends on many factors, including business model, industry type, stage of business, etc. For instance, A B2C brand can acquire a customer via social media or viral marketing. But, B2B products have a higher-learning curve and require educational content. So, they need marketing channels like SEO, email, long-form content, videos, etc.

Decide When to Use Paid and Organic Acquisition Channels

A business can either use paid or organic customer acquisition channels. Channels like paid search, social ads, and display ads are examples of paid acquisition channels. While organic channels include the likes of content marketing, email marketing, SEO, etc.

Paid channels cost business money and can add up quickly when used ineffectively. On the other hand, organic channels are free and only include operational costs like the executive’s salary, tools, etc.

So, which channel should you use?

Paid channels are known to bring lower-quality leads in large numbers, making them ideal for short-term gains. However, for long-term growth, organic channels work best. Even though they generate inbound leads in fewer numbers, they happen to be high-quality.

Use the Right Number of Acquisition Channels

You must also decide how many acquisition channels you should use simultaneously to reduce CAC. Keeping acquisition channels to one or two allows you to become well-known in those channels with limited marketing expenses. And using more channels enables you to spread your brand message to a larger audience.

However, restricting your channels to one or two limits your ability to capture a significant market while also increasing over-reliance on a few customers. And using way too many acquisition channels can lead to uneven distribution of resources among channels and shoot up your marketing expenses.

Identify High-Value Customers

If you want to reduce your CAC, targeting the right customers is most essential. You have better chances of extracting high LTV from your best customers than customers that churn.

Therefore, its good practice to analyze sales and marketing data to identify customers that spend more on your business for every dollar you spend on customer acquisition. Apart from that, your best customers can also include the ones who refer your brand to their colleagues.

Once you have identified your high-value customers, analyze their traits and group customers with similar characteristics together. Next, identify the best customers for all channels you use. Then you can now set the target audience for your paid and organic marketing campaigns accordingly. As a result, there are higher chances of generating better ROI from your marketing efforts.

Optimize Your Funnel

Optimizing your funnel is essential for reducing CAC and improving LTV:CAC ratio. You can improve conversion rates and lower customer acquisition costs by analyzing customer journeys and identifying bottlenecks.

For instance, you can use analytics platforms like Google Analytics to analyze how visitors navigate your website. You can get an idea of which channels and campaigns bring visitors to your website, lead to conversions, or cause customers to drop off the funnel.

Google Analytics 4 also offers several attribution models which rate different touchpoints based on their effectiveness in driving conversions.

Rely on Marketing Automation Tools

As you know, automation is essential for a business to attain operational efficiency. And marketing automation tools can help you reduce CAC by streamlining your sales and marketing processes.

By leveraging EasyInsights’ data analysis capabilities, you can identify high-performing marketing channels, campaigns, or segments. This helps you allocate resources more effectively, focusing on strategies that generate better results. By optimizing your campaigns based on data insights, you can reduce CAC while maximizing the value generated from each customer.

Final Words

LTV:CAC ratio is an important performance metric that allows you to compare your CAC with LTV to calculate whether you suffer a loss or earn profit with every new customer you acquire. And to improve your LTV:CAC ratio, you must reduce your cost of acquiring new customers. You can do so by using the right mix of paid and organic acquisition channels, automating your marketing, and identifying your best customers.

If you deal with multiple marketing platforms and acquisition channels, you need a comprehensive analytics tool like EasyInsights to identify your audience and assess the effectiveness of your marketing efforts.

How EasyInsights can help you work better with Facebook and YouTube Ad Platforms

EasyInsights works with raw Facebook and YouTube data for data activation and data enrichment in a few key ways:

Data Collection and Transformation:

- EasyInsights connect directly to your ad platform allowing it to access and extract the raw data you’ve collected.

- Data Transformation: EasyInsights then cleans, normalizes, and enriches the data to make it usable for activation purposes. This may involve tasks like:

- Formatting data: Ensuring all data points are in a consistent format.

- Handling missing values: Filling in missing data points or removing them according to your preferences.

- Enriching data: Adding additional data points from other sources to create a more comprehensive picture of your customers.

Data Activation:

- Segmentation and Targeting: It allows you to segment your audience based on various criteria like demographics, behavior, and interests using the enriched ad platform data.

- Multi-channel Marketing: You can then use these segments to activate your audience across different marketing channels like email, social media, and advertising platforms.

- Customer Relationship Management (CRM): The data can be used to personalize outreach and interactions with customers within your CRM system.

- Marketing Attribution: EasyInsights can help you understand how different marketing channels contribute to conversions and optimize your marketing spend accordingly.

Key Feature:

- Offers features like customer data platform (CDP) capabilities, marketing automation, and campaign management tools.

- Focuses on reverse ETL (extracting data from your warehouse and sending it to marketing tools) and offers pre-built integrations with various marketing platforms.

EasyInsights is a marketer’s preferred tool for first party data activation.

In this age of cross-channel marketing, EasyInsights offers a comprehensive platform to collect, store, and transform all your first-party data.

EasyInsights enhances marketing campaign efficiency in a cookieless landscape with accurate ad signals. It helps brands step away from surface-level metrics and unleash the potential of first-party data to optimize marketing strategies, ensuring a superior Return on Ad Spend (ROAS). It does all this, while being a highly affordable no-code platform with an exceptional customer support apparatus.

Sign up for a demo today to see EasyInsights in action.